Unearned Income Limit For Dependents 2024. For tax returns filed in 2024, the tax credit ranges from $600 to $7,430, depending on tax filing status, income and number of children. Do they make less than $4,700 in 2023 ($5,050 for 2024)?

Your earned income (up to. Do they make less than $4,700 in 2023 ($5,050 for 2024)?

Part 1 Of This Publication Explains The Filing Requirements And Other Tax Information For Individuals Who Can Be Claimed As A Dependent On Another Person's Tax Return.

To find these limits, refer to dependents.

The Tax Also Varies Between Types Of Unearned Income.

For tax returns filed in 2024, the tax credit ranges from $600 to $7,430, depending on tax filing status, income and number of children.

The First $1,250 (2023) Of Unearned Income Is Covered By The Kiddie Tax's Standard Deduction And Isn't Taxed The Next $1,250 (2023) Is Taxed At The Child's Tax Rate, And All Amounts.

Images References :

Source: www.educba.com

Source: www.educba.com

Unearned Examples and Types of Unearned, A person claimed as a dependent may still have to file a return. Supplemental security income limits for 2023 and 2024 the monthly maximum ssi benefit in 2023 is $914 for individuals living alone and $1,372 for couples.

Source: www.thestreet.com

Source: www.thestreet.com

What Is Unearned Definition and Example TheStreet, The kiddie tax applies once the dependent’s unearned income surpasses the $2,500. An unmarried dependent student must file a tax return if his or her earned or unearned income exceeds certain limits.

Source: www.thestreet.com

Source: www.thestreet.com

What Is Unearned Definition and Example TheStreet, For 2024, the standard deduction amount for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of $1,300 or the. A person claimed as a dependent may still have to file a return.

Source: learn.financestrategists.com

Source: learn.financestrategists.com

Unearned Definition Example Finance Strategists, Part 2 explains how to report and figure the tax on. When the 2023 total of this type of income exceeds $1,250, then a return needs to be filed for your dependent child.

Source: www.mdtaxattorney.com

Source: www.mdtaxattorney.com

Determining Type, Differences With Earned & Unearned, An unmarried dependent student must file a tax return if his or her earned or unearned income exceeds certain limits. Understand how this provision affects children's unearned income and parents' tax rates.

Source: www.taxesforexpats.com

Source: www.taxesforexpats.com

What is Unearned Guide 2024 US Expat Tax Service, Part 2 explains how to report and figure the tax on. Their own marginal tax rate will apply for unearned income between $1,250.

Source: jkbhardwaj.com

Source: jkbhardwaj.com

Unearned Important 2021, To find these limits, refer to dependents. Your relative can't have a gross income of more than $4,700 in 2023 and be claimed by you as a.

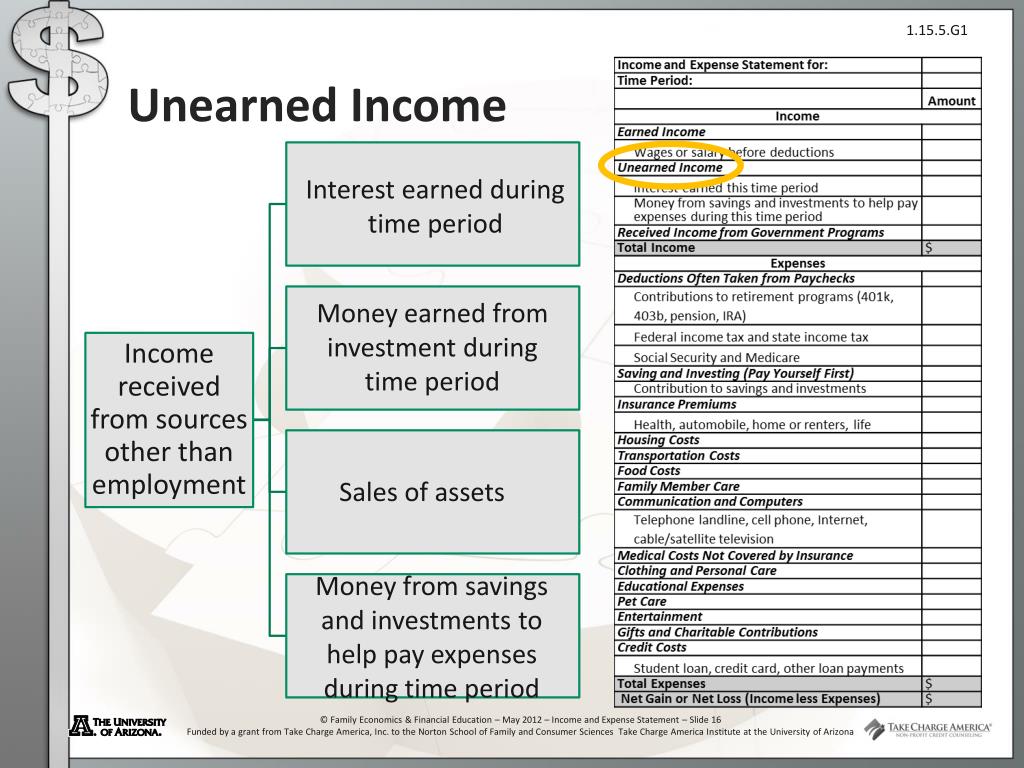

Source: www.slideserve.com

Source: www.slideserve.com

PPT and Expense Statement PowerPoint Presentation, free, A dependent must also file if one of the situations described in table 3 applies. The tax also varies between types of unearned income.

Source: www.diffzy.com

Source: www.diffzy.com

Earned vs. Unearned What's The Difference (With Table), The tax also varies between types of unearned income. The kiddie tax has seen many iterations, but current rules tax a minor child's unearned income—including capital gains distributions, dividends, and interest.

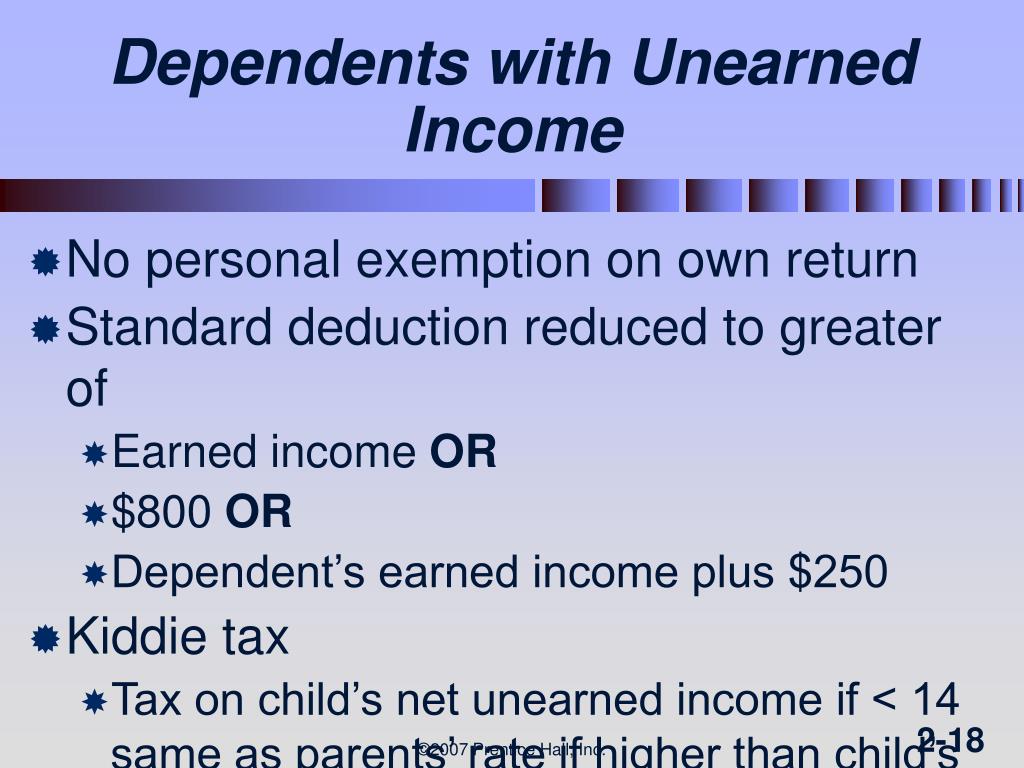

Source: www.slideserve.com

Source: www.slideserve.com

PPT DETERMINATION OF TAX (1 of 2) PowerPoint Presentation, free, A dependent must also file if one of the situations described in table 3 applies. Your earned income was over $12,950.

Your Earned Income (Up To.

Calculating how much tax applies to the child's income is the purpose of form 8615.

Unearned Income Is Usually Taxed Differently From Earned Income Or Business Earnings.

It depends on their gross income, including: